Financial planning is a crucial skill for preppers that often gets overlooked. While knives, guns, and food storage are flashy, financial planning is even more essential. Surprisingly, 41% of people can't handle a small financial setback without going into further debt, emphasizing the importance of financial literacy. In this guide, we will explore the significance of financial preparedness and provide 7 actionable steps to achieve it.

Importance of Financial Preparedness

Financial challenges can arise at personal, regional, national, or global levels. Historical events like the Great Depression and World Wars showcase the impact of financial crises. Lack of financial education exacerbates these challenges, highlighting the need for preparedness. Becoming financially self-sufficient is a key aspect of overall preparedness, ensuring stability and security in the face of uncertainties.

Why Financial Literacy Matters

Early exposure to financial decisions can significantly influence one's financial well-being. Student debt, credit management, budgeting, and investments are critical aspects that require attention. Achieving financial independence, where you are debt-free and have sufficient resources for life, is the ultimate goal.

Steps to Financial Preparedness

Here are seven essential financial strategies every prepper should consider:

- Building an emergency fund

- Managing and reducing debt

- Creating a budget

- Overcoming consumer culture

- Embracing thriftiness

- Investing wisely

- Diversifying investments

Building an Emergency Fund

An emergency fund is crucial to weather unexpected expenses without falling into debt. It is advisable to maintain short-term and long-term emergency savings to cover various scenarios effectively.

Eliminating Debt

Debt can have significant negative impacts on your financial health. Prioritize paying off high-interest debts using strategies like the Avalanche or Snowball method to regain financial stability.

Budgeting Basics

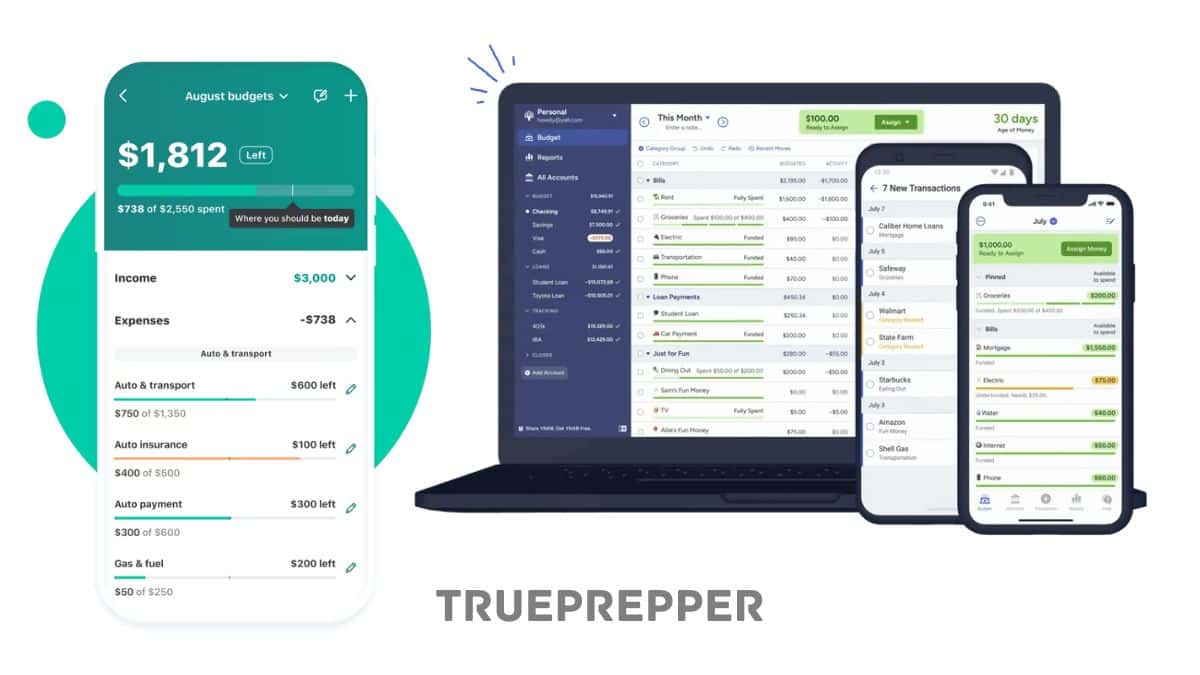

Creating a budget is fundamental to understanding your income and expenses. Utilize simple tools like pen, paper, and spreadsheets to track your finances effectively.

Overcoming Consumerism

Avoid falling into the trap of excessive consumerism by reevaluating your spending habits. Focus on intentional purchases that add value and avoid unnecessary expenses.

Maximizing Your Spending

Stretching your dollar involves smart shopping strategies like buying in bulk, utilizing coupons, and capitalizing on seasonal deals. By being a savvy consumer, you can make the most of your money.

Investing Wisely

Make informed investment decisions to grow your wealth over time. Consider low-fee index funds and diversify your portfolio to mitigate risks and maximize returns.

Diversification Strategies

Diversifying your investments across various asset classes is key to reducing risk exposure. Explore different investment options like stocks, real estate, and precious metals to safeguard your financial future.

Final Thoughts

Financial planning is integral to prepping and overall resilience. By mastering financial literacy and implementing sound strategies, you can navigate uncertainties with confidence. Remember, financial preparedness is a journey, and taking proactive steps today will secure a brighter tomorrow.

—————————————————————————————————————————————————————————————–

—————————————————————————————————————————————————————————————–

By: Sean Gold

Title: Guide to Financial Planning for Preppers

Sourced From: trueprepper.com/financial-planning/

Published Date: Sat, 09 Mar 2024 12:35:30 +0000